24+ high cost mortgage loan

Web For loans higher than 20000 the point and fees threshold references 5 percent of the loan amount For loans less than 20000 the threshold is the lesser of 8 percent of the loan amount of 1000. Web High Cost Mortgage Loan means a Mortgage Loan classified as a a high cost loan under the Home Ownership and Equity Protection Act of 1994.

What Is A High Cost Mortgage In Usa Expertmortgageassistance

Make extra paymentsThis is simply an extra payment over and above the monthly payment.

. You decide on a mortgage loan from Lender X with a 65 percent APR. The maximum limits for 2021 are. Units High-Cost Area Loan Limits Contiguous States District of Columbia and Puerto Rico Alaska Guam Hawaii and the US.

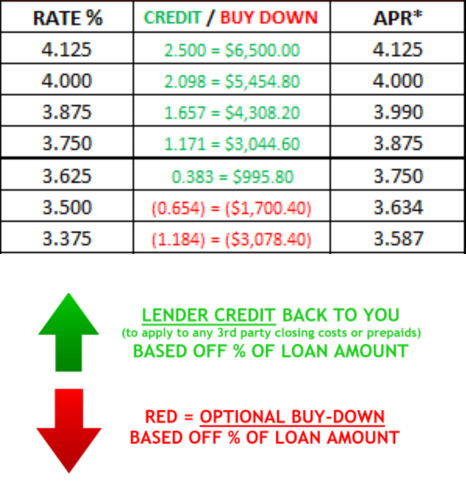

Only principal residences are included in this category. APR Trigger The transactions final APR1. Create more restrictions on mortgage terms including prohibiting balloon payments pre-payment penalties rolling loan fees and costs into the loan loan.

A loan that is subject to the Home Ownership and Equity Protection Act of 1994 HOEPA as described in Section 32 of Regulation Z is not. Web Loans delivered on or after January 1 2005 that meet the definition of high cost home loan under the Indiana Home Loan Practices Act Ind. Web Mortgage interest rates are nearly twice as high as they were at the beginning of 2022 which continues to have a tangible impact on mortgage affordability and consumer housing sentiment.

Web HIGH-COST MORTGAGE LOANS HCMLHOEPA HIGHER-PRICED MORTGAGE LOANS HPML Coverage Consumer-credit transaction open closed-end secured by which trip either the APR or Points consumers principal dwelling with an APR that exceeds the APR trigger described below. Web may potentially be high-cost mortgages and thus must be tested against HOEPAs coverage tests are referred to as transactions that are subject to HOEPA coverage The Dodd-Frank Act also added new protections for high-cost mortgages including a requirement that consumers receive homeownership counseling before obtaining a high. Mortgage loans allow buyers to break up their payments over a set number of years paying an agreed amount of interest.

Lets say youre looking for a mortgage loan thats not a jumbo loan for a new home. Impose additional required counseling requirements. Web A higher-priced mortgage loan HPML is a mortgage with an annual percentage rate APR thats higher than the average prime offer rate APOR offered to well-qualified borrowers.

This section of the regulation requires subject to certain exemptions a credit union to establish escrow. Web A higher-priced mortgage loan is a mortgage loan that meets the corresponding definition under Regulation Z of the Truth in Lending Act. Web Update the triggers interest rate levels APR prepayment clauses to determine if a mortgage qualifies as a high-cost loan.

And on FHFAs website. Loans delivered on or after September 1 2003 that meet the definition. Todays Mortgage Rates Today the average APR for the benchmark 30-year fixed mortgage remained at 311.

24-9-1 et seq notwithstanding the safe harbor language contained in 24-9-1-1. Web A subordinate-lien mortgage is generally higher-priced if the APR of this mortgage is 35 percentage points or more higher than the APOR. Web Here are the average annual percentage rates today on 30-year 15-year and 51 ARM mortgages.

The APOR is set by the Federal Financial Institutions Examination Council FFIEC and is based on a weekly survey of average interest rates and terms. These methods can be used in combination or individually. Web High-cost mortgages include closed- and open-end consumer credit transactions secured by the consumers principal dwelling with an annual percentage rate that exceeds the average prime offer rate for a comparable transaction as of the date the interest rate is set by the specified amount.

Web higher-priced mortgage loan is a closed-end consumer credit transaction secured by the consumers principal dwelling that has an interest rate in excess of established maximums depending on the amount of the loan and the lien position. The term average prime offer rate is defined in 102635a2. Web Aside from paying off the mortgage loan entirely typically there are three main strategies that can be used to repay a mortgage loan earlier.

For mobile homes the points and fees threshold is 3 percent of the loan amount. Web A mortgage is a type of loan designed for buying a home. Borrowers mainly adopt these strategies to save on interest.

B a high cost high risk high rate threshold covered or predatory loan under any other applicable state federal or local law or a similarly classified loan using different te. Web The high-cost area loan limits are established for each county or equivalent and are published on.

G83421mqi002 Gif

Mental Health Statistics You Should Know Policy Advice Policy Advice

Broker Vs Banker Vantage Mortgage Brokers

What Is A High Cost Mortgage In Usa Expertmortgageassistance

Paul Hirschauer At Guaranteed Rate Nmls 235986 Svp Of Mortgage Lending Southington Ct 06489

High Cost Guidelines On Government And Conventional Loans Youtube

Action Plan What To Do With My Optometry Student Loans Before 2023 Ods On Finance

How Mortgage Fees Affect Rates And Spreads Msci

Meet Our Mortgage Loan Officers Santa Clara County Federal Credit Union

Latest In Mortgage News How Much Could A Mortgage Deferral Could Cost You Mortgage Rates Mortgage Broker News In Canada

Start Up Loan

The Mortgage Originator Success Kit The Quick Way To A Six Figure Income Seppinni Darrin J Amazon Com Be Books

Fannie Mae And Freddie Mac Will Require The Use Of Fico Score 10 T

Fee Liability And Grant And Loan Eligibility High Income Individuals Download Scientific Diagram

High Cost Vs Higher Priced Mortgage Loans

Why Am I Being Charged Higher Personal Loan Interest Rates Than Others Moneytap

Arian Eghbali